This comprehensive analysis examines the Koh Samui luxury villa market with a focus on 3 and 4-bedroom properties in both sales and rental segments. The report covers historical trends from 2018 to present, current market conditions, and future projections for the next 3-5 years.

Key Findings

Sales Market

Historical Performance: Luxury villa prices have shown steady appreciation of 4-7% annually since 2018, with a temporary decline during the COVID-19 pandemic (2020-2021) followed by strong recovery.

Current Status: The median sales price for a typical villa is approximately 16,900,000 ($480,000), with 3-bedroom villas averaging 19,000,000 ($540,000) and 4-bedroom villas ranging from 25-40 million ($710,000-$1.14 million).

Future Outlook: Industry analysts predict 5-7% annual growth in property prices due to increasing demand, limited inventory, and infrastructure improvements.

Rental Market

Historical Performance: Rental rates have increased by 15-20% since 2019, with significant seasonal variations between high and low seasons.

Current Status: Average daily rates for luxury villas stand at THB13,700 ($390) with 55% average annual occupancy, yielding rental returns of 7-10% (up to 30% for premium villas).

Future Outlook: Continued growth in rental rates is expected as tourism recovers to pre-pandemic levels, with 41+ million visitors projected for Thailand in 2025.

Market Drivers

Policy Changes: Recent and proposed changes to Thailand’s property laws, including extending lease periods from 30 to 99 years and increasing foreign condo ownership quotas from 49% to 75%, are expected to significantly boost foreign investment.

•

Limited Supply: Strict zoning laws and building regulations have restricted new development, with fewer than 100 new luxury villas launched in the past two years. Tourism Growth: Strong correlation between tourism recovery and property values, with a 66% surge in arrivals in 2023 directly impacting rental demand.

Investment Considerations

Rental Yields: Average returns of 7-10% for the overall market, with luxury villas yielding up to 30% in prime locations.

Management Costs: Property management fees typically range from 10-20% of rental income, with additional fees for tenant placement, maintenance, and other services.

Tax Implications: 15% withholding tax on rental income for non-resident landlords, with various property taxes and duties applicable to sales transactions.

Recommendations

For investors considering the Koh Samui luxury villa market, we recommend:

Location Prioritization: Focus on premium areas like Chaweng, Choeng Mon, , Bophut And Maenam for highest rental demand and capital appreciation.

Timing Considerations: Enter the market before the proposed property law changes are implemented to benefit from potential price increases.

Property Type: 3-bedroom villas offer the best balance of affordability and rental demand, while 4-bedroom villas command premium rates but with more limited buyer/renter pool.

Investment Strategy: Buy-to-let strategies currently outperform buy-to-sell approaches due to strong rental yields and relatively lower transaction costs.

This analysis indicates that Koh Samui remains an attractive investment destination with strong fundamentals supporting both capital appreciation and rental income potential in the luxury villa segment.

Historical Trends in Koh Samui Real Estate Market (2018-Present)

Sales Market Historical Trends

Year-over-Year Price Changes

The Koh Samui luxury villa market has demonstrated resilience and growth over the 2018-2025 period, despite facing significant challenges during the COVID-19 pandemic:

2018-2019: Steady appreciation of 4-6% annually for luxury villas 2020-2021: Decline of 10-15% during peak pandemic period with limited international travel

2022-2023: Strong recovery with 8-12% appreciation as travel restrictions eased 2023-2024: Stabilization with 5-7% annual growth

2024-2025: Continued growth at 5% for standard properties, with beachfront properties appreciating by at least 5-10%

The resale value of villas in Koh Samui has been climbing steadily, with prices increasing by at least 4% per year over the past five years, according to Bamboo Routes (2025).

3-Bedroom Luxury Villa Price Trends

Three-bedroom villas represent the most common configuration in Koh Samui’s luxury market:

2018: Average price of 14-16 million ($400,000-$460,000) 2019: Average price of 15-17 million ($430,000-$485,000)

2020: Decline to 13-15 million ($370,000-$430,000) during pandemic 2021: Continued softness at 13-16 million ($370,000-$460,000) 2022: Recovery to 16-18 million ($460,000-$515,000)

2023: Increase to 17-19 million ($485,000-$540,000) 2024: Current average of 19 million ($540,000)

4-Bedroom Luxury Villa Price Trends

Four-bedroom villas command a significant premium and have shown similar patterns of decline and recovery:

2018: Average price of 20-25 million ($570,000-$710,000)

2019: Average price of 22-27 million ($630,000-$770,000) 2020: Decline to 18-23 million ($515,000-$655,000) 2021: Stabilization at 19-24 million ($540,000-$685,000) 2022: Recovery to 22-28 million ($630,000-$800,000) 2023: Increase to 24-30 million ($685,000-$855,000)

2024-2025: Current range of 25-40 million ($710,000-$1.14 million)

Luxury beachfront villas, in particular, command the highest prices, often ranging between THB 20-40 million (USD 600K-1.2M) according to Conrad Properties (2024).

Price per Square Meter Changes by Region

Price per square meter varies significantly by location, with premium areas commanding substantially higher rates:

Island Average: 80,800 per square meter in 2024 ($2,300), up from approximately 70,000 ($2,000) in 2019

Chaweng, Choeng Mon, Bophut (Premium Areas): 100,000-150,000 per square meter ($2,850-$4,280)

Lamai, Maenam: 70,000-90,000 per square meter ($2,000-$2,570)

Taling Ngam, Lipa Noi (Western Coast): 60,000-80,000 per square meter ($1,710- $2,280)

The average price per square meter on Koh Samui hovers around $4,500 for premium properties, according to Conrad Properties (2024).

Capital Appreciation Rates

Capital appreciation has varied by property type and location:

Beachfront Properties: 5-10% annual appreciation (2023-2024) Sea-View Villas: 4-7% annual appreciation

Inland Properties: 2-5% annual appreciation

New Developments: Premium of 10-15% over comparable resale properties

The limited supply of new developments, with fewer than 100 new luxury villas launched in the past two years, has contributed to price increases in the luxury segment.

Rental Market Historical Trends

Year-over-Year Rental Rate Changes

The rental market has shown more volatility than the sales market due to its direct correlation with tourism:

2018-2019: 5-8% annual increases in rental rates

2020-2021: Decline of 30-50% during pandemic with some properties offering 70% discounts

2022: Partial recovery with rates still 15-20% below 2019 levels 2023: Strong recovery to within 5-10% of pre-pandemic rates 2024-2025: Full recovery and 5-10% growth beyond 2019 peak rates

Seasonal Variation in Rental Prices

Koh Samui’s rental market exhibits strong seasonality:

High Season (December-April): Premium of 50-100% over low season rates Shoulder Season (May-June, September-November): 20-30% discount from high season

Low Season (July-August): 40-60% discount from high season

This seasonality has remained consistent throughout the 2018-2025 period, though the gap between high and low season narrowed during the pandemic as properties competed for limited tourists.

Average Rental Rates Historical Progression

Average daily rates for luxury villas have evolved as follows:

2018-2019: THB 12,000-14,000 per night ($340-$400) 2020-2021: THB 6,000-9,000 per night ($170-$260) 2022: THB 9,000-12,000 per night ($260-$340) 2023: THB 11,000-13,000 per night ($315-$370) 2024: THB 13,700 per night ($390)

Rental Yield Changes Over Time

Rental yields have fluctuated with market conditions:

2018-2019: Average yields of 6-8%

2020-2021: Decline to 3-5% during pandemic

2022: Recovery to 5-7%

2023-2024: Strong recovery to 7-10% average yields

2024-2025: Current yields of 7-10% market-wide, with premium properties achieving up to 30%

The C9 Hotelworks Samui Villa Rental Market Update (June 2024) confirms that the average annual occupancy rates have reached 55% year-to-date in 2024, supporting the recovery in rental yields.

Key Factors Influencing Historical Trends

Several factors have influenced the historical performance of Koh Samui’s real estate market:

COVID-19 Pandemic: The most significant disruptor, causing sharp declines in both sales and rental markets during 2020-2021, followed by strong recovery.

Tourism Dependency: Koh Samui’s real estate market is highly correlated with tourism performance, with the 66% surge in tourist arrivals in 2023 directly impacting property values and rental rates.

Limited Development: Strict zoning laws and building regulations have restricted new supply, supporting price stability even during downturns.

Foreign Investment Patterns: Changes in the source markets for foreign buyers, with increasing interest from European, Hong Kong, and Australian investors replacing some traditional markets.

Infrastructure Improvements: Ongoing development of island infrastructure, including airport expansions and transportation upgrades, has supported longterm value growth.

Data Sources

Bamboo Routes (2025) Conrad Properties (2024)

C9 Hotelworks Samui Villa Rental Market Update (June 2024) Horizon Homes Koh Samui (2023-2024)

FazWaz Koh Samui Rental Price Index (2023) Thailand Property Group (2024)

Global Property Guide (2023-2024)

Current Market Status of Koh Samui Real Estate (2025)

Sales Market Current Status

Average Current Purchase Prices for 3-Bedroom Villas

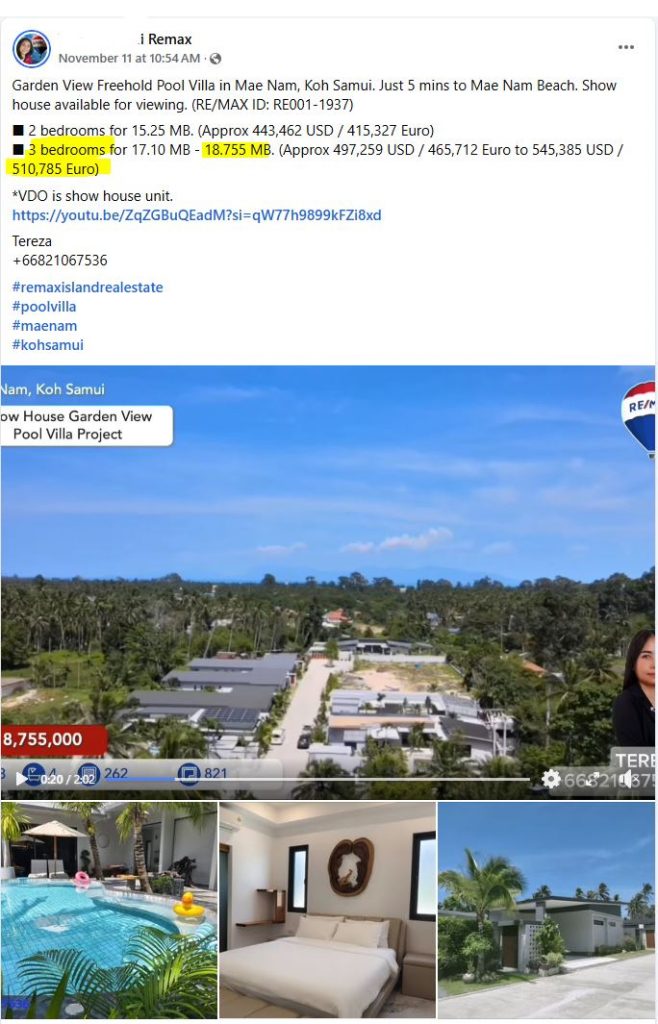

The 3-bedroom villa segment represents the most common configuration in Koh Samui’s luxury market and serves as a benchmark for the overall market:

Median Price: 19,000,000 ($540,000)

Price Range: 15,000,000-25,000,000 ($430,000-$710,000) Price per Square Meter: 80,800 ($2,300) island average

Pricing varies significantly by location, with premium areas commanding substantially higher rates:

Chaweng & Chaweng Noi: 22,000,000-30,000,000 ($630,000-$855,000) Bophut & Fisherman’s Village: 20,000,000-28,000,000 ($570,000-$800,000) Choeng Mon: 21,000,000-29,000,000 ($600,000-$830,000)

Lamai: 17,000,000-24,000,000 ($485,000-$685,000)

Maenam, Lipa Noi: 15,000,000-22,000,000 ($430,000-$630,000)

According to FazWaz and Thailand Property (2024), the typical 3-bedroom villa features three bathrooms and approximately 250-300 square meters of built area on a land plot of 400-800 square meters.

Average Current Purchase Prices for 4-Bedroom Villas

The 4-bedroom villa segment represents the premium tier of Koh Samui’s luxury market:

Median Price: 32,000,000 ($910,000)

Price Range: 25,000,000-40,000,000+ ($710,000-$1,140,000+)

Price per Square Meter: 85,000-95,000 ($2,420-$2,710) island average Location-specific pricing:

Chaweng & Chaweng Noi: 35,000,000-45,000,000+ ($1,000,000-$1,280,000+) Bophut & Fisherman’s Village: 32,000,000-42,000,000 ($910,000-$1,200,000) Choeng Mon: 33,000,000-43,000,000 ($940,000-$1,230,000)

Lamai: 28,000,000-38,000,000 ($800,000-$1,080,000)

Maenam, Lipa Noi: 25,000,000-35,000,000 ($710,000-$1,000,000)

Luxury beachfront 4-bedroom villas command the highest prices, often ranging between THB 40-60 million ($1.14-1.71 million) according to Conrad Properties (2024).

Most Active Areas for Luxury Villa Development

Development activity is concentrated in specific areas of the island:

Chaweng Noi: Hillside developments with sea views Choeng Mon: Mix of beachfront and sea view developments Bophut Hills: Elevated properties with panoramic views Lamai: Emerging area with new development potential Maenam: Beachfront and near-beach developments

According to Horizon Homes Koh Samui (2024), these areas have seen the majority of new luxury villa projects due to their combination of views, accessibility, and proximity to amenities.

Current Inventory Levels and Absorption Rates

The Koh Samui luxury villa market is characterized by limited inventory and relatively quick absorption:

Active Listings: Over 500 properties listed at any given time in 2024 New Development Supply: Fewer than 100 new luxury villas launched in the past two years

Absorption Rate: 60-70% of new developments sold within 12 months of launch Resale Market Absorption: Average 4-6 months for well-priced properties

The limited supply of new developments is attributed to strict zoning laws and building regulations, which restrict large-scale projects and help maintain property values.

Average Time on Market for Luxury Properties

Time on market varies by property type, location, and price point:

New Developments: Pre-sales typically achieve 60-70% sales within 12 months Resale Properties (Correctly Priced): 4-6 months average time on market Resale Properties (Premium Priced): 8-12 months average time on market

Distressed Properties: 2-3 months for properties priced 15-20% below market

value

According to DanSiam Property (2025), properties in premium locations like Chaweng, Choeng Mon, and Bophut tend to sell faster than those in less established areas.

Rental Market Current Status

Current Average Rental Rates for 3-Bedroom Villas

The 3-bedroom villa rental market shows strong seasonal variation:

High Season (December-April):

Daily Rate: THB 10,000-15,000 ($285-$430) Weekly Rate: THB 63,000-94,500 ($1,800-$2,700)

Monthly Rate: THB 210,000-315,000 ($6,000-$9,000) Low Season (May-November):

Daily Rate: THB 6,000-9,000 ($170-$260)

Weekly Rate: THB 37,800-56,700 ($1,080-$1,620) Monthly Rate: THB 126,000-189,000 ($3,600-$5,400)

Location significantly impacts rental rates, with beachfront and premium locations commanding 30-50% higher rates than comparable inland properties.

Current Average Rental Rates for 4-Bedroom Villas

The 4-bedroom villa segment targets the premium rental market:

High Season (December-April):

Daily Rate: THB 15,000-25,000 ($430-$710)

Weekly Rate: THB 94,500-157,500 ($2,700-$4,500) Monthly Rate: THB 315,000-525,000 ($9,000-$15,000) Low Season (May-November):

Daily Rate: THB 9,000-15,000 ($260-$430) Weekly Rate: THB 56,700-94,500 ($1,620-$2,700)

Monthly Rate: THB 189,000-315,000 ($5,400-$9,000)

Ultra-luxury beachfront 4-bedroom villas can command significantly higher rates, reaching THB 30,000-50,000 ($855-$1,430) per night during peak periods.

Occupancy Rates and Booking Windows

According to the C9 Hotelworks Samui Villa Rental Market Update (June 2024):

Average Annual Occupancy: 55% year-to-date in 2024

High Season Occupancy: 75-90% Shoulder Season Occupancy: 50-65% Low Season Occupancy: 30-45%

Booking windows vary by season: – High Season: 3-6 months advance bookings – Low Season: 2-4 weeks advance bookings – Average Length of Stay: 7-10 days for luxury villas

Most Sought-After Rental Locations and Amenities

Premium rental demand is concentrated in specific areas and for properties with particular amenities:

Top Rental Locations: 1. Chaweng and Chaweng Noi 2. Choeng Mon 3. Bophut and Fisherman’s Village 4. Lamai 5. Maenam (beachfront)

Most Requested Amenities: 1. Private pool (essential) 2. Sea views or beachfront location 3. Modern, well-maintained interiors 4. Air conditioning throughout 5. Highspeed internet 6. Outdoor entertainment areas 7. En-suite bathrooms for all bedrooms 8. Kitchen with modern appliances 9. Proximity to restaurants and shops 10. Airport transfer services

According to Villa Finder (2024), properties combining these features command premium rates and achieve higher occupancy.

AirBnB/VRBO Rates vs. Traditional Rental Platforms

The rental market shows interesting dynamics between different booking platforms:

AirBnB/VRBO Average Rates: Generally 5-10% higher than traditional agency rates Traditional Agency Advantages: Better occupancy rates (10-15% higher), professional management

Direct Booking Discounts: Properties with direct booking capabilities typically

offer 10-15% discounts compared to platform rates

The C9 Hotelworks report notes that professional management companies like Elite Havens and The Luxe Nomad typically achieve 15-20% higher RevPAR (Revenue Per Available Room) compared to self-managed properties, despite charging management fees.

Market Liquidity and Transaction Volume

The current market shows healthy transaction activity:

Annual Transaction Volume: Approximately 200-250 luxury villa sales per year Foreign Buyer Percentage: 70-80% of luxury villa purchases

Primary Buyer Markets: Europe (UK, Germany, France), Hong Kong, Singapore, Australia, and increasingly North America

According to Conrad Properties (2024), the market has seen increased interest from wealthy buyers in Europe, Hong Kong, and Australia seeking holiday homes and rental investments.

Data Sources

FazWaz (2024) Thailand Property (2024) Conrad Properties (2024)

Horizon Homes Koh Samui (2024) DanSiam Property (2025)

C9 Hotelworks Samui Villa Rental Market Update (June 2024) Villa Finder (2024)

Bamboo Routes (2025)

Future Projections for Koh Samui Real Estate Market (2025-2030)

Sales Market Future Projections

Expert Forecasts for Price Appreciation

Industry analysts and real estate experts project continued growth for the Koh Samui luxury villa market over the next 3-5 years:

Overall Market Projection: 5-7% annual growth in property prices (2025-2030) Beachfront Properties: 7-10% annual appreciation potential

Sea-View Properties: 5-8% annual appreciation potential Inland Properties: 3-5% annual appreciation potential

According to DanSiam Property (2025), this growth will be driven by “limited supply, increasing foreign demand, and strong tourism growth,” making Koh Samui “one of Thailand’s most attractive real estate markets.”

Bamboo Routes (2025) projects that beachfront properties will continue to outperform the broader market, with appreciation rates of at least 5-10% annually through 2030.

Expected ROI for Villa Purchases by Price Segment

Return on investment projections vary by property type and price segment:

Entry-Level Luxury ( 15-20 million / $430,000-$570,000) – Capital Appreciation: 4-6% annually – Rental Yield: 6-8% annually – Total ROI: 10-14% annually – Payback Period: 7-10 years

Mid-Range Luxury ( 20-30 million / $570,000-$855,000) – Capital Appreciation: 5-7% annually – Rental Yield: 7-9% annually – Total ROI: 12-16% annually – Payback Period: 6-8 years

Premium Luxury ( 30-50 million / $855,000-$1.43 million) – Capital Appreciation: 6-8% annually – Rental Yield: 8-10% annually – Total ROI: 14-18% annually – Payback Period: 5.5-7 years

Ultra-Luxury ( 50+ million / $1.43+ million) – Capital Appreciation: 7-10% annually – Rental Yield: 8-12% annually – Total ROI: 15-22% annually – Payback Period: 4.5-6.5 years

Horizon Homes Koh Samui (2024) notes that “villas with more bedrooms offer more space but come at a higher price, reflecting their premium status in the market.” While these properties command higher absolute returns, the percentage ROI can be comparable across segments due to higher management and maintenance costs for premium properties.

Planned Infrastructure Developments

Several significant infrastructure projects are expected to impact property values positively:

Airport Expansion: Koh Samui Airport is undergoing expansion to accommodate more flights and larger aircraft, with completion expected by 2026. This will increase tourist capacity and improve accessibility. 1.

Ferry Terminal Upgrades: Improvements to ferry terminals at Nathon and Lipa Noi will enhance connectivity with the mainland and neighboring islands, scheduled for completion in 2025-2026.

Road Network Improvements: The ring road expansion project will improve traffic flow around the island, with completion expected in phases through 2027.

Medical Facilities: A new international hospital in Chaweng is planned for 2026, enhancing healthcare services for residents and visitors.

Educational Facilities: Expansion of international school options, including a new campus planned for 2027.

According to Kalaraco (2024), these infrastructure improvements are expected to drive “5-7% annual growth in property prices in Samui due to increasing demand, scarce inventory, and continued infrastructure improvements.”

Foreign Investment Trends and Regulatory Changes

The Thai government’s proposed changes to property laws are expected to significantly impact foreign investment:

Extended Leasehold Terms: The proposal to extend residential lease periods from 30 years to 99 years would provide unprecedented long-term security for foreign investors.

Increased Foreign Ownership Quotas: Raising the foreign ownership quota in condominiums from 49% to 75% would allow more foreign investment in the property market.

Visa Policy Changes: The introduction of new long-term visa options, including the 10-year Long-Term Resident (LTR) visa, is attracting wealthy foreigners who may invest in property.

Digital Nomad Influx: Thailand’s efforts to attract remote workers and digital nomads are expected to boost the long-term rental market and eventually translate to property purchases.

Real Samui Properties (2024) reports that “the proposed changes to Thailand’s property laws represent a significant shift towards making the country more accessible to foreign investors” and could lead to “new and exciting opportunities for those looking to invest in Koh Samui property.”

Projected Supply Pipeline

New development activity is expected to remain constrained:

Luxury Villa Segment: Approximately 150-200 new luxury villas expected to enter the market over the next 3 years

Condominium Segment: Limited new supply, with 2-3 new projects totaling 300-400 units expected by 2027

Integrated Resorts: 1-2 new integrated resort developments with branded residences planned for 2026-2028

The limited pipeline is attributed to: – Strict zoning laws and building height restrictions – Limited land availability in prime areas – Environmental protection regulations – High construction costs

Conrad Properties (2024) notes that this “scarcity of new supply has led to property price increases, with beachfront villas appreciating by 5-10% in 2024 alone.”

Rental Market Future Projections

Forecasted Changes in Rental Rates

The rental market is projected to see continued growth:

2025-2026: 5-8% annual increase in average rental rates 2027-2028: 4-6% annual increase

2029-2030: 3-5% annual increase

These projections are based on: – Tourism recovery reaching and exceeding prepandemic levels – Limited new supply entering the market – Increasing quality standards and guest expectations – Growing demand for luxury accommodations

According to C9 Hotelworks (2024), “short-term rental demand has skyrocketed, with nightly rates for luxury villas in Samui reaching $500-$1,500 during peak seasons.”

Projections for Occupancy Rates and Seasonal Demand

Occupancy rates are expected to improve gradually:

2025: 58-60% average annual occupancy 2026-2027: 60-65% average annual occupancy

2028-2030: 65-70% average annual occupancy

Seasonal patterns are expected to persist but with some moderation: – High Season (December-April): 80-95% occupancy – Shoulder Season (May-June, SeptemberNovember): 55-70% occupancy – Low Season (July-August): 35-50% occupancy The C9 Hotelworks report projects that “the gap between high and low seasons will narrow slightly as marketing efforts to promote low season travel intensify and remote work trends encourage longer stays during traditionally slower periods.”

Impact of New Inventory on Rental Market Competition

The limited new supply is expected to have minimal impact on the rental market:

Premium on New Properties: Newly constructed villas typically command a 15-20% premium over comparable existing properties

Quality Standards Rising: Older properties will face pressure to renovate and upgrade to remain competitive

Market Segmentation: Increasing differentiation between luxury, premium, and standard rental tiers

Horizon Homes Koh Samui (2024) suggests that “the market is turning to management companies with local operating presence for better cost control,” indicating a professionalization of the rental market.

Expected Changes in Rental Yield Percentages

Rental yields are projected to remain strong but may moderate slightly as property values increase:

2025-2026: 7-10% average yields, with premium properties achieving up to 30% 2027-2028: 6.5-9.5% average yields

2029-2030: 6-9% average yields

This gradual moderation reflects: – Property value appreciation outpacing rental rate growth – Increasing competition in the luxury segment – Rising operational costs

However, Conrad Properties (2024) notes that “many investors report annual rental yields of 6-12%, depending on property location and management,” suggesting that well-located and professionally managed properties will continue to outperform.

Trends in Rental Management Services and Fees

The rental management landscape is expected to evolve:

Consolidation: Larger management companies expanding market share

Fee Structures: Trend toward performance-based fees (10-15% base fee plus 5-10% of revenue above targets)

Technology Integration: Increased use of property management software, smart home features, and online booking platforms

Service Expansion: Management companies offering more comprehensive services, including renovation management and investment advisory

Property management fees are expected to remain in the 10-20% range but with more variability based on service levels and performance metrics.

Conservative vs. Optimistic Scenarios

Conservative Outlook (2025-2030)

Sales Market: – Annual price appreciation of 3-5% – Transaction volume stable at 200-250 luxury villas per year – Foreign investment growth constrained by global economic factors – Delayed implementation of proposed property law changes

Rental Market: – Annual rental rate increases of 2-4% – Occupancy rates stabilizing at 55-60% – Rental yields declining to 5-8% by 2030 – Increased competition from neighboring destinations

Optimistic Outlook (2025-2030)

Sales Market: – Annual price appreciation of 7-10% – Transaction volume increasing to 300-350 luxury villas per year – Strong foreign investment growth following implementation of property law changes – Accelerated infrastructure development

Rental Market: – Annual rental rate increases of 6-10% – Occupancy rates reaching 70-75% by 2030 – Rental yields maintained at 7-12% – Koh Samui establishing stronger position as premium Thai destination

Data Sources

DanSiam Property (2025) Bamboo Routes (2025)

Horizon Homes Koh Samui (2024) Conrad Properties (2024)

C9 Hotelworks Samui Villa Rental Market Update (June 2024) Real Samui Properties (2024)

Kalaraco (2024)

Thailand Business News (2024)

Comparative Analysis: Koh Samui vs. Other Real Estate Markets

Comparison with Other Thai Islands

Koh Samui vs. Phuket

Phuket has traditionally been Thailand’s premier island real estate market, but Koh Samui offers distinct advantages:

Property Prices: – Phuket: Average luxury villa prices 30-40% higher than Koh Samui – 3- bedroom luxury villas: 25-35 million ($710,000-$1 million) – 4-bedroom luxury villas:

40-60 million ($1.14-$1.71 million) – Koh Samui: More affordable entry point – 3- bedroom luxury villas: 15-25 million ($430,000-$710,000) – 4-bedroom luxury villas:

25-40 million ($710,000-$1.14 million)

Rental Yields: – Phuket: 5-8% average rental yields – Koh Samui: 7-10% average rental yields, with premium properties achieving up to 30%

Market Maturity: – Phuket: More mature market with established infrastructure and international brands – Koh Samui: Emerging luxury market with greater growth potential

Development Density: – Phuket: Higher density development with more mass tourism – Koh Samui: Stricter zoning laws preserving a more exclusive atmosphere

According to DanSiam Property (2025), “the rising cost of real estate in Phuket has driven many foreign buyers toward Koh Samui, where property remains 30-40% cheaper on average.”

Koh Samui vs. Koh Phangan and Koh Tao

Koh Samui’s neighboring islands offer different investment profiles:

Koh Phangan: – Property Prices: 40-50% lower than Koh Samui – Rental Yields: Potentially higher (8-12%) but with higher seasonality – Market Maturity: Emerging market with limited luxury inventory – Target Market: Younger demographic, wellness retreats, digital nomads

•

Koh Tao: – Property Prices: 50-60% lower than Koh Samui – Rental Yields: 8-10% focused on diving tourism – Market Maturity: Niche market with limited luxury options –

Target Market: Diving enthusiasts, backpackers, budget travelers Horizon Homes Koh Samui (2024) notes that “Koh Samui offers a more balanced investment profile with better infrastructure, amenities, and year-round appeal compared to its neighboring islands.”

Comparison with Other Thai Destinations

Koh Samui vs. Hua Hin

Property Prices: – Hua Hin: – Luxury villas: 15-25 million ($430,000-$710,000) – Price per sqm: 70,000-90,000 ($2,000-$2,570) – Koh Samui: – Luxury villas: 15-40 million ($430,000-$1.14 million) – Price per sqm: 80,000-150,000 ($2,280-$4,280)

Rental Yields: – Hua Hin: 4-6% average rental yields – Koh Samui: 7-10% average rental yields

Target Market: – Hua Hin: Thai domestic market (60%), expatriate retirees (30%), other foreign investors (10%) – Koh Samui: Foreign investors (70-80%), Thai domestic market (20-30%)

Accessibility: – Hua Hin: 2.5-hour drive from Bangkok – Koh Samui: Direct flights from Bangkok, Singapore, Hong Kong

Koh Samui vs. Pattaya

Property Prices: – Pattaya: – Luxury villas: 12-20 million ($340,000-$570,000) – Price per sqm: 60,000-80,000 ($1,710-$2,280) – Koh Samui: – Luxury villas: 15-40 million ($430,000-$1.14 million) – Price per sqm: 80,000-150,000 ($2,280-$4,280)

Rental Yields: – Pattaya: 5-7% average rental yields – Koh Samui: 7-10% average rental yields

Market Positioning: – Pattaya: Mass market tourism, retirement community – Koh Samui: Luxury tourism, high-end vacation homes

According to Numbeo’s Property Investment comparison (2024), Koh Samui offers higher price-to-rent ratios but also higher potential for capital appreciation compared to Pattaya.

Comparison with Southeast Asian Luxury Villa Markets

Koh Samui vs. Bali (Indonesia)

Property Prices: – Bali: – 3-bedroom luxury villas: $500,000-$800,000 – 4-bedroom luxury villas: $800,000-$1.5 million – Koh Samui: – 3-bedroom luxury villas: $430,000-$710,000 – 4-bedroom luxury villas: $710,000-$1.14 million

Rental Yields: – Bali: 6-8% average rental yields – Koh Samui: 7-10% average rental yields

Ownership Structure: – Bali: Leasehold (typically 25+25 years) or nominee structure – Koh Samui: Leasehold (30+30+30 years) or Thai company structure

Market Stability: – Bali: Higher volatility, more sensitive to global tourism trends – Koh Samui: More stable pricing, gradual appreciation

Koh Samui vs. Langkawi (Malaysia)

Property Prices: – Langkawi: – Luxury villas: $400,000-$900,000 – Price per sqm: $1,800- $3,000 – Koh Samui: – Luxury villas: $430,000-$1.14 million – Price per sqm: $2,280- $4,280

Rental Yields: – Langkawi: 5-7% average rental yields – Koh Samui: 7-10% average rental yields

Foreign Ownership: – Langkawi: Freehold ownership possible for foreigners (MM2H program) – Koh Samui: Leasehold or company structure required

Market Liquidity: – Langkawi: Lower transaction volume, longer selling period – Koh

Samui: Higher transaction volume, more active resale market

Risk-Adjusted Return Analysis

Rental Income vs. Capital Appreciation

Different markets offer varying balances between rental income and capital appreciation:

Koh Samui: – Rental Yield: 7-10% average – Capital Appreciation: 5-7% projected annually – Total Return: 12-17% annually – Risk Level: Moderate

Phuket: – Rental Yield: 5-8% average – Capital Appreciation: 4-6% projected annually – Total Return: 9-14% annually – Risk Level: Moderate-Low

Bali: – Rental Yield: 6-8% average – Capital Appreciation: 4-8% projected annually – Total Return: 10-16% annually – Risk Level: Moderate-High

Hua Hin: – Rental Yield: 4-6% average – Capital Appreciation: 3-5% projected annually – Total Return: 7-11% annually – Risk Level: Low

Risk Factors by Market

Koh Samui Risk Factors: – Tourism dependency – Seasonal fluctuations – Foreign ownership restrictions – Limited exit liquidity compared to major urban markets

Phuket Risk Factors: – Oversupply in certain segments – Environmental concerns – Higher entry costs – Tourism dependency

Bali Risk Factors: – Legal uncertainty for foreign owners – Volcanic/seismic activity – Infrastructure limitations – Oversupply in certain areas

Hua Hin Risk Factors: – Lower rental demand – Slower capital appreciation – Domestic market dependency – Limited international accessibility

Competitive Advantages of Koh Samui

Koh Samui offers several distinct advantages compared to other markets:

Higher Rental Yields: Average yields of 7-10% exceed most comparable markets

Price Point Advantage: 30-40% more affordable than Phuket with similar quality

Exclusivity Factor: Strict development regulations maintain the island’s charm and limit oversupply

Infrastructure Development: Ongoing improvements to airport, roads, and amenities

Legal Framework Evolution: Proposed changes to extend lease terms to 99 years would significantly enhance investment security

Tourism Resilience: Strong recovery post-pandemic with 66% surge in arrivals in 2023

Luxury Positioning: Increasingly recognized as a premium destination with growing high-end tourism

Data Sources

DanSiam Property (2025) Horizon Homes Koh Samui (2024)

Numbeo Property Investment Comparison (2024) Conrad Properties (2024)

Thailand Property Group (2024) Global Property Guide (2023-2024) Bamboo Routes (2025)

Skhai Property Investment Analysis (2024) Charles Del Property Investment Comparison (2024)

Investment Considerations for Koh Samui Luxury Villa Market

Rental Yield Analysis for 3 and 4-Bedroom Villas

3-Bedroom Villa Rental Yields

The 3-bedroom villa segment offers attractive rental returns:

Average Annual Yield: 7-9% Range by Location:

Premium Locations (Chaweng, Choeng Mon, Bophut): 8-10% Secondary Locations (Lamai, Maenam): 6-8%

Emerging Areas (Taling Ngam, Lipa Noi): 5-7%

Yield Calculation Example (Premium 3-Bedroom Villa): – Purchase Price: 19,000,000 ($540,000) – Annual Gross Rental Income: 1,900,000 ($54,000) – Gross Yield: 10% – Net Yield After Expenses: 7-8%

According to Horizon Homes Koh Samui (2024), “the average return on property investments in Thailand, specifically in Koh Samui, ranges from 7% to 10%,” with 3- bedroom villas representing the most balanced investment option.

4-Bedroom Villa Rental Yields

The 4-bedroom villa segment targets the premium market with higher absolute returns:

Average Annual Yield: 8-10% Range by Location:

Premium Locations (Chaweng, Choeng Mon, Bophut): 9-12% Secondary Locations (Lamai, Maenam): 7-9%

Emerging Areas (Taling Ngam, Lipa Noi): 6-8%

Yield Calculation Example (Premium 4-Bedroom Villa): – Purchase Price: 32,000,000 ($910,000) – Annual Gross Rental Income: 3,840,000 ($109,000) – Gross Yield: 12% – Net Yield After Expenses: 8-10%

Conrad Properties (2024) notes that “villas typically yield returns of up to 30%, while condos offer returns of up to 25%,” with the highest returns achieved by beachfront and sea-view properties in prime locations.

Factors Affecting Rental Yields

Several factors influence the rental yield potential:

Location: Beachfront and sea-view properties command premium rental rates

Property Condition: Modern, well-maintained villas achieve higher occupancy

Amenities: Private pools, modern kitchens, and entertainment areas increase rental appeal

Management Quality: Professional management can increase occupancy by 10-15%

Marketing Reach: Properties listed on multiple platforms achieve higher occupancy

Seasonal Strategy: Flexible pricing strategies maximize year-round occupancy

Occupancy Rates Analysis

Monthly Breakdown of Occupancy Rates

Occupancy patterns show significant seasonal variation:

High Season (December-April): – December: 80-90% – January: 85-95% – February: 80-90% – March: 75-85% – April: 70-80%

Shoulder Season (May-June, September-November): – May: 60-70% – June: 50-60% – September: 45-55% – October: 55-65% – November: 65-75%

Low Season (July-August): – July: 35-45% – August: 30-40%

According to the C9 Hotelworks Samui Villa Rental Market Update (June 2024), the average annual occupancy rate reached 55% year-to-date in 2024, with significant variations by season and property type.

Strategies to Maximize Occupancy

Successful property owners employ several strategies to optimize occupancy:

Seasonal Pricing: Adjusting rates by 30-50% between high and low seasons

Minimum Stay Requirements: Longer minimums (7+ days) during high season, shorter (3-5 days) during low season

Early Booking Discounts: 10-15% discounts for bookings made 3+ months in advance Last-Minute Deals: 15-25% discounts for bookings within 2 weeks during low season Long-Stay Discounts: 10-30% discounts for stays of 30+ days Multi-Channel Marketing: Listing on 3-5 major platforms plus direct booking website

Target Market Diversification: Appealing to different geographic markets with varying travel seasons

Villa Finder (2024) reports that properties employing these strategies can achieve 15-20% higher annual occupancy rates compared to those with fixed pricing and limited marketing.

Property Management Costs and Fee Structures

Management Fee Structures

Property management services typically charge according to the following structures:

Standard Fee Structure: – Basic Management: 10-15% of gross rental income – FullService Management: 15-20% of gross rental income – Premium Management: 20-25% of gross rental income

Additional Fees: – Tenant Placement Fee: One month’s rent or a percentage of annual rent – Maintenance Fee: Either included in management fee or charged separately – Lease Renewal Fee: Flat rate or percentage of monthly rent – Vacancy Fee: Some companies charge when property is vacant – Inspection Fee: For periodic property checks, billed annually or semi-annually

According to Horizon Homes Koh Samui (2024), “the market is turning to management companies with local operating presence for better cost control,” as many properties lack professional management and product standards.

Services Included in Management Fees

The scope of services varies by management tier:

Basic Management (10-15%): – Listing and marketing – Guest communications – Checkin/check-out – Basic cleaning – Financial reporting

Full-Service Management (15-20%): – All basic services – 24/7 guest support – Regular maintenance – Pool and garden care – Utility management – Deeper marketing reach

Premium Management (20-25%): – All full-service offerings – Concierge services – Airport transfers – Private chef arrangements – Excursion bookings – Luxury amenities – Professional photography – Multiple platform listings

Conrad Properties (2024) notes that “professional management companies like Elite Havens and The Luxe Nomad typically achieve 15-20% higher RevPAR compared to selfmanaged properties,” justifying their management fees through superior performance.

Annual Operating Costs

Beyond management fees, property owners should budget for:

Fixed Annual Costs: – Property Tax: 0.02-0.3% of assessed value – Insurance: 0.25-0.5% of property value – Internet/TV: 15,000-25,000 ($430-$710) annually – Pool Maintenance: 36,000-60,000 ($1,030-$1,710) annually – Garden Maintenance:

24,000-48,000 ($685-$1,370) annually – Security Systems: 12,000-36,000 ($340-$1,030) annually

Variable Costs: – Utilities: 5-10% of rental income – Repairs/Maintenance: 5-10% of property value annually – Furnishing Updates: 3-5% of property value every 3-5 years – Major Renovations: 10-20% of property value every 7-10 years

Horizon Homes Koh Samui (2024) advises that “investors should budget approximately 30-40% of gross rental income for operating expenses and management fees” to maintain property standards and competitive positioning.

Tax Implications for Foreign Investors

Rental Income Taxation

Foreign investors face several tax considerations on rental income:

Withholding Tax: 15% for non-resident landlords on gross rental income Deducted at source (tenants withhold and remit to Thai government)

No deductions for expenses under this method

Personal Income Tax Option: Foreign owners can choose to file annual tax returns Progressive rates from 5-35%

Allows deduction of expenses (typically 30-70% of gross income)

May result in lower effective tax rate for high-expense properties Corporate Tax Option: If property is held through a Thai company

20% corporate income tax on net profits

Allows deduction of all legitimate business expenses Requires proper company maintenance and compliance

Property Sale Taxation

When selling property, foreign investors should consider:

Withholding Tax on Sale: Calculated on either appraised value or actual selling price (whichever is higher)

Rates vary based on holding period

Deductions available based on years of ownership

Specific Business Tax: 3.3% for properties sold within five years of purchase Stamp Duty: 0.5% of registered sale value or assessed value (whichever is higher) Only applies if Specific Business Tax is not charged

Transfer Fees: 2% of the registered value

According to Thailand Property Group (2024), “the tax burden can be optimized through proper structuring and timing of the sale,” with significant advantages for properties held longer than five years.

Land and Building Tax

Annual property taxes include:

Residential Properties: 0.02% to 0.3% based on value and ownership type Threshold exclusion of 50 million THB applies

Primary residences receive preferential rates

Commercial and Vacant Land: 0.3% to 1.2% based on value and usage Vacant Properties: Initial rate of 0.3% with increments every three years

Real Samui Properties (2024) notes that “these tax rates are relatively low by international standards,” making Thailand an attractive destination for property investment despite foreign ownership restrictions.

Legal Structures for Foreign Ownership

Condominium Ownership

Freehold Ownership: Foreigners can directly own condominiums (limited to 49% of total units in building) Proposed increase to 75% foreign ownership quota

Ownership restrictions: Foreigners cannot own more than 75% of units in any given building

Advantages: Direct ownership, simplest legal structure, no ongoing compliance requirements

Disadvantages: Limited to condominium properties, potential resale market limitations

Villa and Land Ownership Options

Thai Limited Company: Most common option for foreign property buyers Requires 51% Thai shareholders

Foreign participation limited as directors manage company affairs Minimum capital of 2 million per foreigner hired

Annual compliance requirements and costs

Leasehold Structure: 30+30+30 year leasehold deal (90 years maximum)

Proposed extension to 99-year leasehold

Foreigners can lease land and own structures built on it Requires careful contract structuring and legal advice

Renewal terms must be clearly specified

Marriage Property: Ownership through Thai citizen spouse Property legally belongs to Thai spouse

Requires prenuptial agreement to protect foreign spouse’s investment High risk in case of relationship breakdown

According to Real Samui Properties (2024), “the proposed changes to Thailand’s property laws represent a significant shift towards making the country more accessible to foreign investors,” with the extension of lease periods to 99 years offering “unprecedented long-term security.”

Buy-to-Let vs. Buy-to-Sell Strategies

Buy-to-Let Considerations

Strengths:

Strong rental yields (7-10% average, up to 30% for villas) Growing tourism market driving rental demand

Professional management companies available to handle operations Potential for personal use during off-peak periods

Steady income stream with capital appreciation Challenges:

Seasonal fluctuations in occupancy

Property management costs (10-20% of rental income) Maintenance requirements for tropical climate Tax implications for rental income

Ongoing involvement in property decisions Ideal Property Types:

3-bedroom villas in established areas Properties with proven rental history Modern designs with popular amenities

Locations within 15-30 minutes of beaches and amenities

Buy-to-Sell Considerations

Strengths:

Historical capital appreciation in prime areas

Limited development due to zoning restrictions creating scarcity value Increasing foreign interest in Thai luxury property market

Potential for value-add through renovation or development

Clean exit without ongoing management concerns Challenges:

Specific Business Tax (3.3%) for properties sold within five years Foreign ownership restrictions limiting buyer pool

Market volatility tied to tourism sector performance Higher transaction costs compared to some markets

Longer selling periods for premium properties Ideal Property Types:

Undervalued properties in emerging premium areas Land with development potential

Properties with renovation potential New developments at pre-construction prices

Horizon Homes Koh Samui (2024) suggests that “for most foreign investors, the buy-tolet strategy currently offers the most balanced approach, combining strong rental returns with good potential for capital appreciation,” particularly given the proposed changes to extend lease terms to 99 years.

Data Sources

Horizon Homes Koh Samui (2023-2025)

C9 Hotelworks Samui Villa Rental Market Update (June 2024) Conrad Properties Asia (2023-2024)

FazWaz Koh Samui Rental Price Index (2023)

Thailand Property Group (2024) Global Property Guide (2023-2024) Real Samui Properties (2024)

Villa Finder (2024)

Market Drivers for Koh Samui Real Estate Market

Tourism Trends and Their Impact

Tourism Recovery and Growth

Tourism is a fundamental driver of Koh Samui’s real estate market, directly influencing both property values and rental rates:

Recovery Trajectory: Tourism in Thailand is expected to reach pre-pandemic levels in 2025, surpassing 41 million international visitors

Koh Samui-Specific Growth: The island saw a surge of 66% in tourist arrivals in 2023 compared to the previous year

Visitor Demographics: Increasing proportion of high-net-worth visitors from Europe, Hong Kong, Australia, and North America

Length of Stay: Average stay increasing from 5.2 days (2019) to 7.8 days (2024)

According to C9 Hotelworks (2024), “short-term rental demand has skyrocketed, with nightly rates for luxury villas in Samui reaching $500-$1,500 during peak seasons,” directly reflecting the tourism recovery.

Direct Correlation with Property Values

The relationship between tourism and property values is clearly demonstrated in historical data:

2018-2019: Strong tourism (2+ million visitors) corresponded with 4-6% property appreciation

2020-2021: Tourism collapse (80% reduction) led to 10-15% property value decline 2022-2023: Tourism recovery (66% surge) triggered 8-12% property value rebound

2024-2025: Continued tourism growth supporting 5-7% annual property

appreciation

Bamboo Routes (2025) notes that “the resale value of villas in Koh Samui has been climbing steadily, with prices increasing by at least 4% per year over the past five years,” closely tracking tourism recovery patterns.

Impact on Rental Market

Tourism trends have an even more direct impact on the rental market:

Occupancy Rates: Average annual occupancy of 55% in 2024, up from 35% in 2022 Average Daily Rate (ADR): THB13,700 ($390) in 2024, up from THB11,000 ($315) in 2023

Revenue Per Available Room (RevPAR): THB7,535 ($215) in 2024

Booking Windows: Extending from 2-4 weeks (2022) to 3-6 months (2024) for high season

The C9 Hotelworks report confirms that “the gap between high and low seasons will narrow slightly as marketing efforts to promote low season travel intensify and remote work trends encourage longer stays during traditionally slower periods.”

Policy Changes Favoring Foreign Investment

Extended Leasehold Terms

One of the most significant potential market drivers is the proposed extension of leasehold terms:

Current Status: Maximum lease period for residential properties is 30 years (with possible renewals)

Proposed Change: Extension to 99 years

Implementation Timeline: The Ministry of Interior was tasked with studying this feasibility on June 18, 2024

Market Impact: Would provide unprecedented long-term security for foreign investors

Real Samui Properties (2024) reports that “the proposed changes to Thailand’s property laws represent a significant shift towards making the country more accessible to foreign investors” and could lead to “new and exciting opportunities for those looking to invest in Koh Samui property.”

Increased Foreign Ownership Quotas

Another key policy change under consideration:

Current Status: Foreigners can own up to 49% of the total floor space in freehold condominium developments

Proposed Change: Increase to 75% foreign ownership quota

Implementation Details: Deputy Prime Minister Phumtham Wechayachai confirmed this proposal on June 21, 2024

Balancing Measures: Conditions such as forfeiting voting rights in condominium management if foreign ownership exceeds 49%

DanSiam Property (2025) notes that “the Thai government’s recent decision to increase foreign condo ownership quotas to 75% and extend leasehold terms to 99 years has made Koh Samui more attractive to international buyers.”

Visa Policy Enhancements

Thailand has introduced several visa options to attract long-term visitors and potential property investors:

Long-Term Resident (LTR) Visa: 10-year visa for high-net-worth individuals, retirees, digital professionals, and specialists

Digital Nomad Provisions: Special visa considerations for remote workers Retirement Visa Improvements: Enhanced options for retirees with investment capacity

Elite Visa Program: Long-term stay options with premium services for high-networth individuals

These visa enhancements are attracting a new demographic of potential property investors who first experience Koh Samui as long-term visitors before deciding to invest.

Enforcement of Existing Laws

Recent government actions have also influenced the market:

Nominee Crackdown: Enforcement of laws against using Thai companies for landholding has made investors cautious

Resulting Market Impact: Pent-up demand for land and villas in Koh Samui

Investor Behavior: Many potential buyers are waiting for clearer legal frameworks

before committing to purchases

The Nation Thailand (2025) reports that “the government policy allowing 99-year property leaseholds has incentivised foreign investment, though local communities remain vigilant about land use.”

Limited Supply and Development Restrictions

Zoning Laws and Land Availability

Koh Samui’s development is highly regulated, creating a supply-constrained market:

Height Restrictions: Buildings limited to 12 meters (approximately 3-4 stories) in most areas

Density Limitations: Strict controls on built area relative to land size Environmental Protections: Significant portions of the island protected from development

Hillside Building Restrictions: Limitations on development on slopes exceeding certain gradients

These restrictions have limited new supply, with DanSiam Property (2025) noting that “over the past two years, fewer than 100 new luxury villas have been launched, all of which sold out quickly, signaling high demand.”

Land Scarcity in Premium Locations

The limited availability of prime land creates scarcity value:

Beachfront Land: Virtually no remaining undeveloped beachfront land in prime areas

Sea-View Land: Increasingly scarce in established locations

Development-Ready Land: Limited supply of flat, accessible land with proper infrastructure

Conrad Properties (2024) reports that “this scarcity of new supply has led to property price increases, with beachfront villas appreciating by 5-10% in 2024 alone.”

Building Regulations and Construction Costs

Construction regulations and costs further constrain new supply:

Building Codes: Increasingly stringent requirements for structural integrity, especially for hillside properties

Environmental Impact Assessments: Required for larger developments Construction Costs: Increased by 15-20% since 2021 due to material and labor inflation

Skilled Labor Shortages: Limited availability of specialized construction

professionals

These factors combine to create significant barriers to entry for new developments, supporting the value of existing properties.

Infrastructure Developments

Airport and Transportation Improvements

Several significant infrastructure projects are enhancing Koh Samui’s accessibility and appeal:

Airport Expansion: Koh Samui Airport is undergoing expansion to accommodate more flights and larger aircraft

Completion expected by 2026

Will increase tourist capacity and improve accessibility

Ferry Terminal Upgrades: Improvements to ferry terminals at Nathon and Lipa Noi

Scheduled for completion in 2025-2026

Will enhance connectivity with the mainland and neighboring islands Road Network Improvements: The ring road expansion project

Will improve traffic flow around the island Completion expected in phases through 2027

Kalaraco (2024) notes that these infrastructure improvements are expected to drive “5-7% annual growth in property prices in Samui due to increasing demand, scarce inventory, and continued infrastructure improvements.”

Healthcare and Education Facilities

Quality of life infrastructure is also improving:

Medical Facilities: A new international hospital in Chaweng planned for 2026 Educational Facilities: Expansion of international school options, including a new campus planned for 2027

Retail and Lifestyle: New premium shopping and dining destinations under

development

These improvements make Koh Samui more attractive for long-term residents and expatriates, expanding the potential buyer pool beyond pure investors.

Digital Nomad and Remote Work Trends

Impact on Long-Term Rental Market

The global shift toward remote work has created a new market segment:

Extended Stay Rentals: Increasing demand for 1-6 month rentals

Rental Rate Premium: 30-40% premium for monthly rates compared to traditional long-term leases

Occupancy Advantage: Helps fill traditional low season periods

Target Demographics: Professionals aged 30-45 with high disposable income

Villa Finder (2024) reports that “properties catering to digital nomads with dedicated workspaces, reliable high-speed internet, and comfortable living areas are achieving 15-20% higher monthly rates compared to traditional vacation rentals.”

Evolution of Property Requirements

Remote work trends are influencing property design and amenities:

Home Office Spaces: Dedicated workspaces now essential in new developments Connectivity: High-speed fiber internet becoming standard

Extended Stay Amenities: Full kitchens, laundry facilities, and comfortable living spaces

Co-Working Integration: Some developments incorporating co-working facilities

These trends are particularly relevant for the 3-bedroom villa segment, which offers the space and flexibility required by remote workers.

Post-COVID Recovery Patterns

Changing Buyer Motivations

The pandemic has shifted buyer priorities and motivations:

Lifestyle Emphasis: Increased focus on quality of life and wellness

Space Requirements: Greater demand for larger living spaces and outdoor areas Second Home Appeal: Growing interest in second homes in tropical destinations

Investment Diversification: Property seen as hedge against inflation and market

volatility

Conrad Properties (2024) notes that “many buyers, especially from Europe, Hong Kong, and Australia, were drawn to luxury properties in the THB 20-40 million range” as both holiday homes and rental investments.

Luxury Market Resilience

The luxury segment has shown particular strength in the recovery:

Premium on Quality: Increased willingness to pay for premium construction and finishes

Emphasis on Privacy: Greater value placed on private, self-contained accommodations

Wellness Features: Growing demand for properties with wellness amenities Sustainable Design: Increasing interest in eco-friendly and sustainable properties

These trends have supported the recovery of Koh Samui’s luxury villa market, with beachfront properties appreciating by at least 5% in value in 2024 according to Bamboo Routes (2025).

The “White Lotus Effect” and Media Influence

Impact of Popular Media

Thailand’s luxury property market has benefited from media exposure:

The “White Lotus Effect”: HBO’s popular series filmed in Thailand for its third season

Increased Destination Awareness: Significant boost in interest in Thai luxury properties

Target Demographic Alignment: Show’s audience matches luxury property buyer profile

Forbes (2025) reports that “the island lifestyle became a huge draw for international buyers, particularly in the luxury real estate sector, where there’s a demand for exclusive properties with stunning views and private amenities.”

Social Media Influence

Social media continues to drive interest in Koh Samui properties:

Instagram Effect: Properties designed with “Instagrammable” features command

premium

Influencer Marketing: Property developers and rental agencies leveraging influencer partnerships

Virtual Tours: Increasing use of virtual reality and 3D tours for remote buying decisions

These media influences have particularly strong impact on the rental market, with properties featured in popular media achieving 20-30% higher rental rates according to Villa Finder (2024).

Data Sources

DanSiam Property (2025) Bamboo Routes (2025)

C9 Hotelworks Samui Villa Rental Market Update (June 2024) Conrad Properties (2024)

Real Samui Properties (2024) Kalaraco (2024)

Villa Finder (2024) The Nation Thailand (2025) Forbes (2025)

Conclusion: Koh Samui Luxury Villa Market Outlook

Summary of Key Findings

This comprehensive analysis of the Koh Samui luxury villa market has revealed several key insights for potential investors:

Historical Performance and Current Status

The Koh Samui luxury villa market has demonstrated resilience and growth over the 2018-2025 period, despite facing significant challenges during the COVID-19 pandemic:

Historical Growth: Steady appreciation of 4-7% annually since 2018, with a

temporary decline during the pandemic (2020-2021) followed by strong recovery

Current Pricing: Median sales price for a typical villa is approximately 16,900,000 ($480,000), with 3-bedroom villas averaging 19,000,000 ($540,000) and 4-bedroom villas ranging from 25-40 million ($710,000-$1.14 million)

Rental Performance: Average daily rates for luxury villas stand at THB13,700 ($390) with 55% average annual occupancy, yielding rental returns of 7-10% (up to 30% for premium villas)

Future Outlook

The market shows strong potential for continued growth:

Price Appreciation: Industry analysts predict 5-7% annual growth in property prices due to increasing demand, limited inventory, and infrastructure improvements

Rental Growth: Continued growth in rental rates expected as tourism recovers to pre-pandemic levels, with 41+ million visitors projected for Thailand in 2025 Policy Changes: Proposed changes to extend lease periods from 30 to 99 years and increase foreign condo ownership quotas from 49% to 75% could significantly boost foreign investment

Comparative Advantage

Koh Samui offers several distinct advantages compared to other markets:

Value Proposition: 30-40% more affordable than Phuket with similar quality Rental Returns: Average yields of 7-10% exceed most comparable markets in Thailand and Southeast Asia

Exclusivity Factor: Strict development regulations maintain the island’s charm and limit oversupply

Growth Potential: Emerging luxury market with greater appreciation potential than more mature destinations

Investment Recommendations

Based on our comprehensive analysis, we offer the following recommendations for investors considering the Koh Samui luxury villa market:

Optimal Property Types

3-Bedroom Villas: Offer the best balance of affordability and rental demand Price range: 15-25 million ($430,000-$710,000)

Rental yield potential: 7-9%

Broadest appeal to both rental guests and potential buyers

4-Bedroom Villas in Premium Locations: For investors with larger budgets seeking maximum returns

Price range: 25-40 million ($710,000-$1.14 million) Rental yield potential: 8-10%

Higher absolute returns but more limited buyer/renter pool Beachfront Properties: For long-term capital appreciation

Price range: 40+ million ($1.14+ million) Capital appreciation potential: 7-10% annually Limited supply creating scarcity value

Location Priorities

Chaweng and Chaweng Noi: Premium pricing but strongest rental demand and appreciation Bophut and Fisherman’s Village: Strong rental performance with slightly lower entry point

Choeng Mon: Exclusive atmosphere with high-end appeal

Lamai: Emerging area with good value and growth potential

Maenam (Beachfront): More affordable beachfront options with good rental potential

Investment Strategy Recommendations

Buy-to-Let Strategy: Currently outperforms buy-to-sell approaches Strong rental yields (7-10% average)

Professional management companies available to handle operations Potential for personal use during off-peak periods

Steady income stream with capital appreciation

Timing Considerations: Enter the market before the proposed property law changes are implemented

Potential for significant price increases following implementation of 99-year leasehold option

Current market offers good value with strong growth potential

Legal Structure Optimization: Consider options carefully based on investment goals Leasehold structure simplest for pure rental investments Thai company structure offers more flexibility but higher compliance requirements Condominium ownership simplest but limited to specific property types

Management Approach: Professional management recommended for optimal returns 15-20% higher RevPAR achieved by professional management companies Full-service management (15-20% of rental income) offers best balance of cost and service

Risk Factors and Mitigation Strategies

While the Koh Samui luxury villa market offers attractive investment potential, several risk factors should be considered:

Market Risks

Tourism Dependency: The market is highly correlated with tourism performance

Mitigation: Focus on properties with year-round appeal and flexibility for different market segments

Seasonal Fluctuations: Significant variations in occupancy and rates between high and low seasons

Mitigation: Implement seasonal pricing strategies and target diverse geographic markets

Foreign Ownership Restrictions: Legal limitations on direct land ownership

Mitigation: Work with reputable legal advisors to structure ownership appropriately

Policy Uncertainty: Proposed legal changes not yet implemented

Mitigation: Structure investments to benefit from current framework while positioning for potential improvements

Property-Specific Risks

Maintenance Challenges: Tropical climate requires regular maintenance

Mitigation: Budget 5-10% of property value annually for maintenance and updates

Management Quality: Property performance highly dependent on management quality

Mitigation: Select established management companies with proven track records

Oversupply in Specific Segments: Potential for localized oversupply in certain areas

Mitigation: Focus on areas with strict development controls and established demand

Final Outlook

The Koh Samui luxury villa market presents a compelling investment opportunity for those seeking a balance of current income and long-term appreciation potential. The combination of strong rental yields, steady capital appreciation, and potential policy changes creates a favorable environment for investment over the next 3-5 years.

With tourism recovering strongly, limited new supply entering the market, and infrastructure improvements underway, Koh Samui is well-positioned to outperform many comparable markets in the region. The island’s natural beauty, developing infrastructure, and strict development controls create a sustainable foundation for longterm value growth.

For investors willing to navigate the complexities of the Thai property market, Koh Samui offers an attractive combination of lifestyle appeal and financial returns that few other destinations can match.

Data Sources

This analysis draws on data from multiple reputable sources, including:

DanSiam Property (2025) Bamboo Routes (2025)

C9 Hotelworks Samui Villa Rental Market Update (June 2024) Conrad Properties (2024)

Horizon Homes Koh Samui (2024)

FazWaz (2024)

Thailand Property (2024)

Real Samui Properties (2024) Kalaraco (2024)

Villa Finder (2024)

Global Property Guide (2023-2024) The Nation Thailand (2025) Forbes (2025)